Don’t buy the crypto dip, invest in affordable land at Sparta Grounds

Bitcoin Market Capitalization is down by more than 60 percent

Buying Cryptocurrency Vs. Investing Real Estate

You don’t buy real estate; you invest in real estate. Investing is buying for long-term gains. Also, land is proven to appreciate with time and yield positive returns over the years. Even billionaires invest a great share of their wealth in real estate. Owning a property can bring a steady source of income through rentals for example. On the other hand, people will always need a place to live, work, walk, or do anything whatsoever. Meanwhile, rooted in anti-capitalist ideologies, cryptocurrency has yet to prove its intrinsic value to humanity.

| Cryptocurrency | Real-Estate |

|---|---|

| High risk | Low risk |

| Volatile | Steady |

| Low entry-barrier | High entry-barrier |

| Decentralized | Centralized and regulated |

| Low maintenance | High maintenance |

| Uncertain profitability | High profitability |

| Not recommended by billionaires | Strongly recommended by billionaires |

| Small capital | Big capital * |

| Limited Resource | Limited Resource |

| Did not gain enough credibility | Constant demand |

| Long-term gains | Steady source of income |

| Digital asset | Tangible asset |

*: At Sparta, investing in land has never been more affordable. You do not need to take out big loans to buy land. Check out how easy and affordable becoming a landowner is with Sparta more about our Zero Percent Financing Program and the Group Investment Program.

Nobody saw the crash of FTX coming.

What was considered one of the safest and most reliable cryptocurrency exchange platforms turned out to be an example highlighting the extreme volatility of the virtual currency. The fall pushed users to withdraw billions of dollars from different exchanges causing a dip in the price of several digital coins. Bitcoin is trading – at the time of writing – at $15,600, accentuating a 67.25 percent dip from one year to date.

Compared to one year ago, the Bitcoin market cap was at $1 Trillion, today the market stands at circa $300 Billion and is not expected to hold due to the buyers’ weakening confidence in cryptocurrencies.

The Current Economic Status Quo

Unevenly rising prices curbing purchasing powers signaled global rising inflation, this is due to the disruption of the supply chain caused by Covid-19 and the aftermath of the Russian-Ukrainian war.

In general, inflationary environments push risk assets down the slippery slope, among them of course, no other than cryptocurrency. It is inevitable that such a young and volatile currency will sustain a global recession, at times when foreign exchange markets keep reflecting currency pressures and devaluations against the U.S. Dollar.

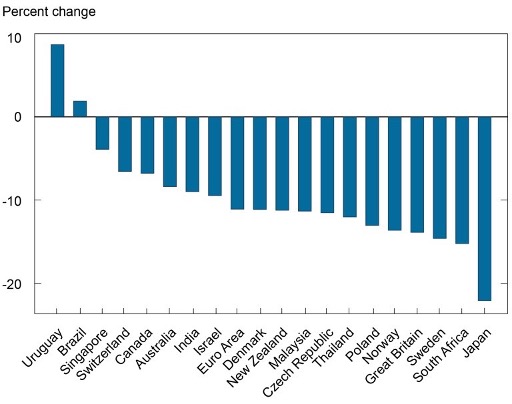

Change in Nominal Currency Values vis-à-vis the U.S. Dollar (January-October 2022)

Change in Nominal Currency Values vis-à-vis the U.S. Dollar (January-October 2022)

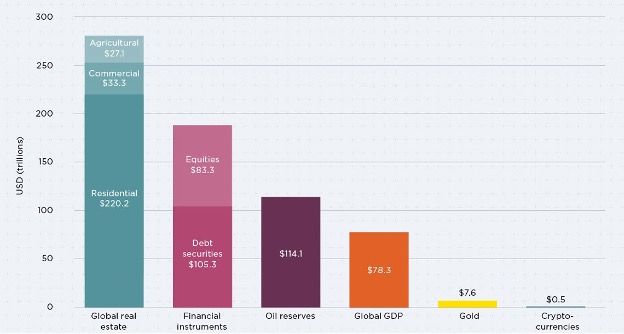

The global economic role of real estate

The global economic role of real estate

Want to grow your net worth? Consider real estate as a top priority

Given the choice between a high-risk volatile asset and a low-risk steady one, you would choose the safest. However, given the practicality and convenience of digital payments, cryptocurrency is gaining wider popularity among the younger generation that has, sooner than expected, let go of the digital asset in fear of losing more than what they have already lost during the past year.

To know more about how you can start growing your net worth by investing in land, contact one of our agents to learn about the Zero Percent Financing Program and Sparta Grounds’ Investment Club.