Investing in Land vs. High Interest Savings Account?

The myth of saving money

Growing up the rule was simple, save your money. Take it to the bank and throw it in a savings account and call it a day. I wasn’t guided any other way. What’s the money for? A rainy day they said. So, I saved, and I waited, that rainy day came, and I wish I had invested rather than saved.

If you’re lucky and have a good amount of savings, you can earn about 3% interest on your money in a High Interest Savings account. While you’re only getting 3% the bank is taking your saved money and is investing it with a much higher return. Pretty annoying huh?

Land investment

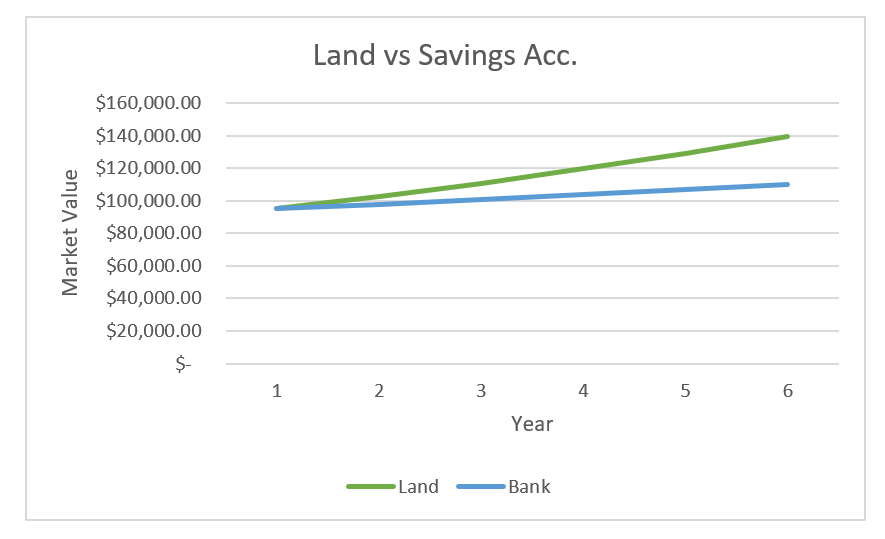

On a bad year, land will see on average 5-8% year over year growth! Low cost of ownership is also great as it doesn’t dig into the returns. Owning land will always be more rewarding over a savings account. Here’s a quick snapshot of a 5-year ROI on $95K invested in land vs H.I Savings.

Graph visualized above projects an 8% year over year growth based on a 3-year average for land in Nova Scotia. It’s a very conservative number given 2021 growth was 12.5% in Nova Scotia alone for vacant land. This is also taking in consideration no enhancements have been done to the lot, for example if you add a driveway this can increase the value as well. The bank rate used was 3% yearly, most Canadian banks will only give between 1-3.5% high interest savings account. Which also is limited to those returns. With land you have the option to increase the value via enhancements or simple by using it to generate income.

Conclusion

Are savings accounts completely useless? The answer is NO! Should you just keep saving and leave it in there? NO! Utilize the savings account temporarily to save enough for that land purchase. Save with a purpose of saving for real estate. Investing in real estate protects you and your future wealth from inflation.